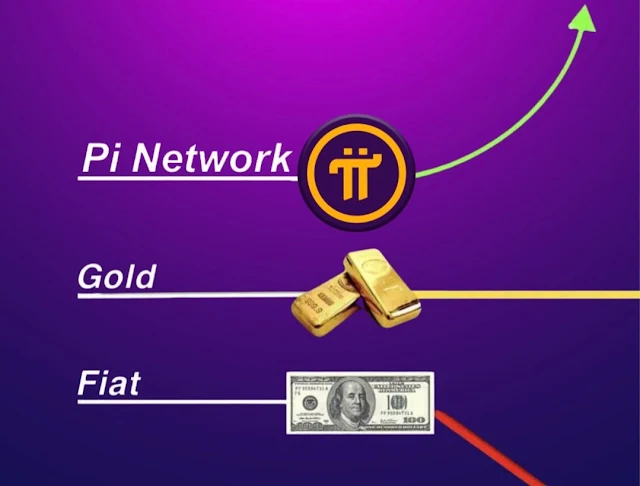

Breaking! Comparative Growth Potential: Pi Network, Gold, and Fiat Currency - hokanews

hokanews.com - the ever-evolving digital age, many investors are seeking new opportunities to secure and increase the value of their assets. In this endeavor, various options emerge, including digital currencies like Pi Network, physical assets like gold, and conventional fiat currencies.

Pi Network: A Community-Driven Digital Currency

Pi Network is one of the most attention-grabbing digital currencies in recent years. What sets Pi Network apart from many other digital currencies is its highly community-based approach. Launched in 2019 by a team of developers inspired by blockchain technology, Pi Network allows users to earn Pi coins through a lighter form of digital mining compared to Bitcoin.

Currently, Pi Network is still in its early development stages. Pi coins are not yet traded on major exchanges like Bitcoin or Ethereum. However, the growth potential of Pi Network is quite promising. The main factor is that Pi Network is still in an experimental phase, and Pi coins are granted as incentives to community members who contribute.

However, it's important to note that investing in digital currencies always carries inherent risks. The digital currency market is highly volatile, and the price of Pi Network can change rapidly as it becomes more widely recognized.

Gold: A Trusted Store of Value

Gold has been recognized as a reliable store of value for thousands of years. Gold's value is not only based on its beauty but also on its scarcity and unchangeable physical nature. This makes gold a sought-after asset during times of economic uncertainty or inflation.

While gold may not experience price surges like those often seen with digital currencies, it remains a stable and reliable asset. Its price can fluctuate, but its history shows that its value tends to rise over time. This makes gold a sound choice for investors looking for long-term store-of-value assets.

Fiat Currency: Vulnerable to Inflation

Fiat currency, such as the dollar or the euro, is money issued by governments and regulated by central banks. One of the main issues with fiat currency is that it is vulnerable to inflation. When central banks print more money or inject it into the system, the value of fiat currency can diminish over time.

Fiat currency is rarely used as an investment for growth. Instead, it is primarily used for day-to-day transactions and as a medium of exchange. However, as an investment tool, fiat currency carries the risk of inflation. If the inflation rate is higher than the return on investment, your purchasing power can erode over time.

In choosing between Pi Network, gold, or fiat currency as a store of value or investment, there is no one-size-fits-all option. Diversification is key to managing risk and achieving your financial goals.

🔥Pi Network vs. Gold vs. Fiat Currency: Store of Value🔥

— Cryptoleakvn (@cryptoleakvn) September 26, 2023

- Pi Network is a digital currency with potential value growth in its early stages, driven by its unique community-driven approach.

- Gold has a long history as a reliable store of value due to its scarcity and physical… pic.twitter.com/5dxV4hUzco

Pi Network offers an attractive growth potential but comes with higher risks. Gold is a stable asset with a long history as a store of value. Fiat currency is essential for day-to-day transactions, although it is vulnerable to inflation.

In making investment decisions, it's always wise to consult with a financial advisor or conduct in-depth research on the assets you're considering. With a solid understanding of each option, you can build a smart portfolio that aligns with your financial objectives.